I would like to invite you to the third and final article in the series 'How to get your own M'. Today's topic will deal with the issue of how to rental and purchase of housing in the context of the contracts themselves. You will learn what to look out for in the negotiation process with both the tenant and the seller of the flat. In addition, we will briefly discuss the basic elements of both contracts. I hope that the following tips will be helpful to you and that you will not allow yourself to be "tricked into the proverbial bottle".

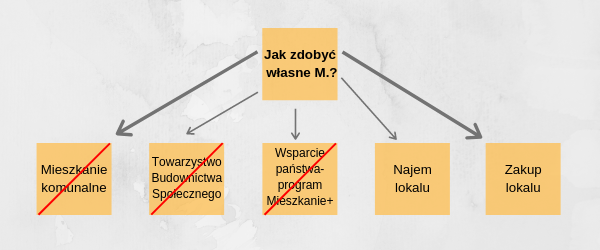

At the same time, I encourage you to read the other articles in this series:

How to get council housing? A series of articles on how to get your own M.

TBS housing and the "Mieszkanie +" programme

In the meantime, I invite you to read the details of the entry below. Here we go!

A thorough discussion of all aspects of the rental agreement and the problem of purchasing a flat would require several lengthy articles. I will, however, try to present the most important elements and highlight the potential risks as briefly and clearly as possible.

Leasing and buying a flat - some technical notes

To begin with, a few technical notes that are valid for both the rental agreement and the purchase of a flat. It is advisable to familiarise yourself thoroughly before entering into negotiations:

- with the technical condition of the premises (in the case of rental and purchase of secondary market premises) or

- the planned layout and location of the flat in the event that we are dealing with a development flat that has not yet been built.

It is worth taking a look around and making sure that the location suits you and that the infrastructure you need, such as shops and schools, is nearby. In addition, it is worth checking the available public transport and the commuting time.

Before buying a flat or signing a tenancy agreement, it is important to check that the person you are signing a tenancy agreement with is actually the owner of the property. It is often possible to come across fraudsters who take advantage of the naivety or inexperience of others. It is a good idea to check the land register.

The land register is the official register that determines the legal status of real estate, i.e. flats, houses, building plots and land, as well as the cooperative ownership right to a flat. It shows:

- who owns the property,

- whether the seller has a proprietary right to the cooperative premises,

- whether a mortgage has been established on it,

- the location of the flat and its size.

If the landlord/seller is not the owner, he/she should have the appropriate power of attorney to act on behalf of the owner. In the case of a rental agreement, a simple written power of attorney is sufficient. However, in the case of a sale, a notarised power of attorney is required. This is because the power of attorney must correspond to the form in which the contract is concluded. The contract for sale of the property is concluded at a notary public. It is also advisable to check the land register and ask for the title to the premises in the form of a notarial deed.

1. rental housing

Before signing a contract, it is important to read all its terms and conditions carefully. The first step is to check that the details on the contract match, i.e. that you are indeed signing with the right person.

Fees, maintenance costs, utilities

Naturally, for renting a flat, the tenant is obliged to pay rent. However, it is often forgotten about the additional charges that may be imposed on the tenant. Before signing, it is important to check whether the agreement includes additional costs such as e.g. rent paid to the housing association, electricity, water, gas, heating, parking space, Internet, television, landline telephone, etc., or whether the tenant will be obliged to pay some costs separately. It is also worth making it clear how the charges are to be paid. We can agree with the landlord that we will pay the entirety of the charges into his account or transfer them in cash. Sometimes the landlord wants the tenant to make his or her own advance payments for utilities or to pay rent to the housing association.

Security deposit and termination

A point in the contract with which it is mandatory for every tenant to familiarise themselves is the termination provisions. Attention should be paid to:

- the method of termination (e.g. in writing),

- a notice period of, for example, one month or three months, and

- reserving a possible contractual penalty for early termination. It is advisable to be aware of your obligations in this respect.

Another element of a tenancy agreement is very often a security deposit. This is the tenant's obligation to pay the landlord a certain amount to cover any damages or arrears in payment. Most often, the deposit is equivalent to one month's rent, but you should check the amount carefully in the contract to avoid an unpleasant surprise.

Handover and acceptance protocol (lease and purchase of accommodation)

The landlord should attach a handover and acceptance protocol to the tenancy agreement. If it does not do so, you can draw up such a protocol yourself. This is a very important element. It should include a list of equipment in the flat and meter readings as at the date of delivery. You should also include photographs. When you inspect the accommodation, pay particular attention to any defects, damage or deterioration and ask for this information to be included in the report. Otherwise, you run the risk of being charged at the end of the lease for repairs to items that were already broken by someone else.

2. purchase of premises from the secondary market

An unquestionable advantage of buying a flat from the secondary market is the fact that all the defects and structural flaws have already "come to the surface". Possible cracks in the walls or other defects in the construction of the building have certainly already come to light - you will be able to verify them and make an informed decision.

What should you check before buying? The list is long. In addition to the information I mentioned at the beginning of the article, we should verify that the person selling us the flat is not in arrears with payments. To do this, it is worth asking for a certificate from the housing association. It is equally important to check whether there is a mortgage on the flat. In this respect, you should check the contents of the land and mortgage register of the apartment (Section IV of the land and mortgage register). It is also worth conducting your own small "investigation" among neighbours, checking the reputation of your potential contracting party and whether there was any fire or flooding in the flat in the last few years before the sale. Once you have gathered all the necessary information and made the decision to buy, it is time to prepare the contract. The sale of the flat, as I mentioned above, must take place in the form of a notarial deed. However, it is advisable to visit a lawyer before going to the notary in order to prepare a contract that adequately protects your interests. We will of course be happy to assist you in this regard.

3. purchase of a flat from the primary market

Many guides and handbooks have already been written on the subject of buying a flat from a developer. The subject is so vast and complicated that it is difficult to cover all the issues in just a few pages. Therefore, I will briefly summarise the most important issues that you need to be aware of before taking any action.

Creditworthiness (tenancy and purchase of housing)

If we are planning to buy a flat using a bank loan, we first need to determine our creditworthiness, i.e. how much of a loan the bank will be able to make available to us. Determining our creditworthiness will give us a point of reference and allow us to see what kind of property we can afford. It is also worth taking into account that, in the case of a property developer's flat, a considerable part of the costs is spent on finishing the new premises. For this reason, it is advisable to divide the savings between the own contribution to the loan and the fund for further work on the flat.

Prospectus

This is a document that you should analyse very carefully before deciding to purchase a flat. Pursuant to the so-called "Development Act", in force since 2012, we have the right to request an information prospectus of the investment from the seller. The prospectus should contain, among other things, information on:

- what experience the developer has - the prospectus will list completed investments,

- whether enforcement proceedings are pending against the developer,

- what is the legal status of the plot - is it encumbered (e.g. does it secure a bank loan),

- what the zoning plan of neighbouring plots of land looks like - this information is particularly important if you want to ensure that the view from your window is not obscured by a taller building,

- whether the investment has the necessary permits,

- what is the deadline for completion and transfer of ownership of the property.

Preliminary agreement

It is standard practice to sign a preliminary contract. Its most important element is, of course, the commitment of both parties to conclude the final contract, transferring ownership of the premises, at a certain point in the future. In addition, the preliminary contract should contain, among other things, information on:

- the price of the property and its location,

- dates for payment of the deposit,

- the payment dates for subsequent tranches,

- the date of handover of the premises.

Development agreement (lease and purchase of a dwelling)

The developer's agreement is the most important piece of the puzzle in relation to the purchase of our own home. It is worth reading it very carefully before signing. What do you need to pay attention to? Here the list of risks is also very long. Among other things, you should check whether:

- the parties to the contract as indicated in the compilation are correct,

- the relevant land registers are given - it is also worth re-checking their contents,

- any easements encumbering the property were indicated in the development agreement, and the

- what the price payment schedule looks like,

- the process of handing over the premises and

- what is the developer's liability for physical defects in the premises,

- who bears the notarial costs.

It can be very difficult for someone unfamiliar with the way a development agreement is formulated to grasp all of the above elements. Therefore, it is worth taking advantage of the assistance of a lawyer who will review the agreement for you. He will point out potential risks and guide you through the process of negotiating with the developer.